Θετικά πρόσημα επικράτησαν και σήμερα στα περισσότερα ευρωπαϊκά χρηματιστήρια, με τον κλάδο των χρηματοοικονομικών εταιρειών να σημειώνει τα μεγαλύτερα κέρδη και αυτόν των βασικών καταναλωτικών αγαθών να είναι ο μόνος που ολοκλήρωσε σε αρνητικό έδαφος.

Διάθεση για ρίσκο εμφάνισαν και σήμερα οι επενδυτές στα ευρωπαϊκά χρηματιστήρια, ωθούμενοι κυρίως από τα καλύτερα των εκτιμήσεων εταιρικά οικονομικά αποτελέσματα που ανακοινώθηκαν από ευρωπαϊκές εταιρείες.

Οι γερμανικές βιομηχανικές παραγγελίες μειώθηκαν τον Μάρτιο κατά 0,4% σε σχέση με τον προηγούμενο μήνα σε εποχικά και ημερολογιακά προσαρμοσμένη βάση, ανακοίνωσε την Τρίτη η ομοσπονδιακή στατιστική υπηρεσία.

Δημοσκόπηση του Reuters μεταξύ αναλυτών είχε δείξει αύξηση 0,4%.

Στα κυριότερα μακροοικονομικά νέα:

Στην Βρετανία, ο δείκτης Τιμών Κατοικιών Halifax για τον μήνα Απρίλιο ενισχύθηκε 0,1% έναντι εκτιμήσεων των οικονομολόγων για αύξηση 0,2% και υποχώρησης 0,9% τον προηγούμενο μήνα (αναθεωρημένο από το -1%). Ο δείκτης PMI Κατασκευών για τον μήνα Απρίλιο διαμορφώθηκε στις 53,0 μονάδες έναντι εκτιμήσεων των οικονομολόγων για 50,4 μονάδες και 50,2 μονάδες τον προηγούμενο μήνα.

Στην Γερμανία, οι βιομηχανικές παραγγελίες για τον μήνα Μάρτιο υποχώρησαν 0,4% έναντι εκτιμήσεων των οικονομολόγων για αύξηση 0,4% και μείωσης 0,8% τον προηγούμενο μήνα (αναθεωρημένο από το +0,2%). Το εμπορικό ισοζύγιο για τον μήνα Μάρτιο διαμορφώθηκε στα 22,3 δισ. ευρώ έναντι εκτιμήσεων των οικονομολόγων για 22,4 δισ. ευρώ και 21,4 δισ. ευρώ τον προηγούμενο μήνα.

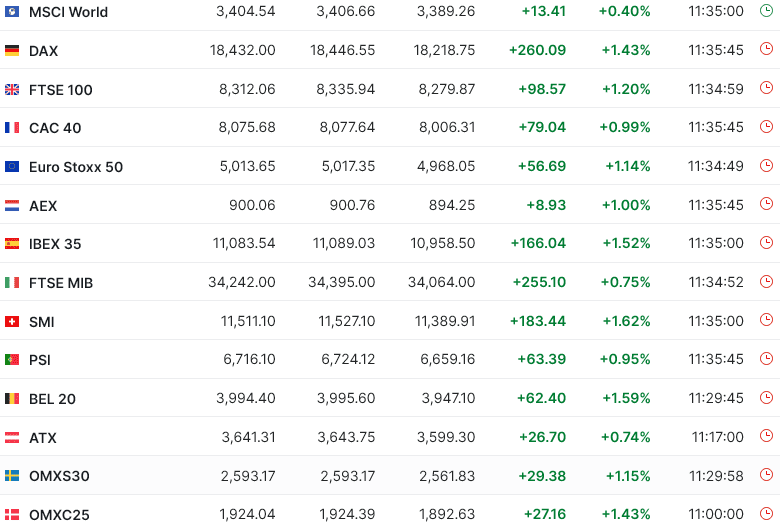

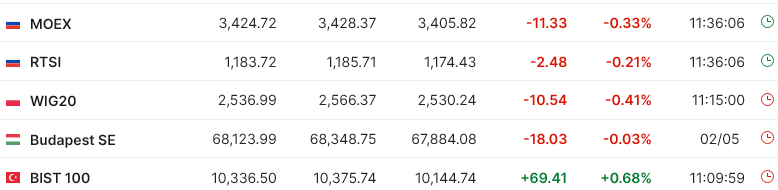

Ο δείκτης Stoxx 600 έκλεισε στις 514,04 μονάδες με άνοδο 1,15%.

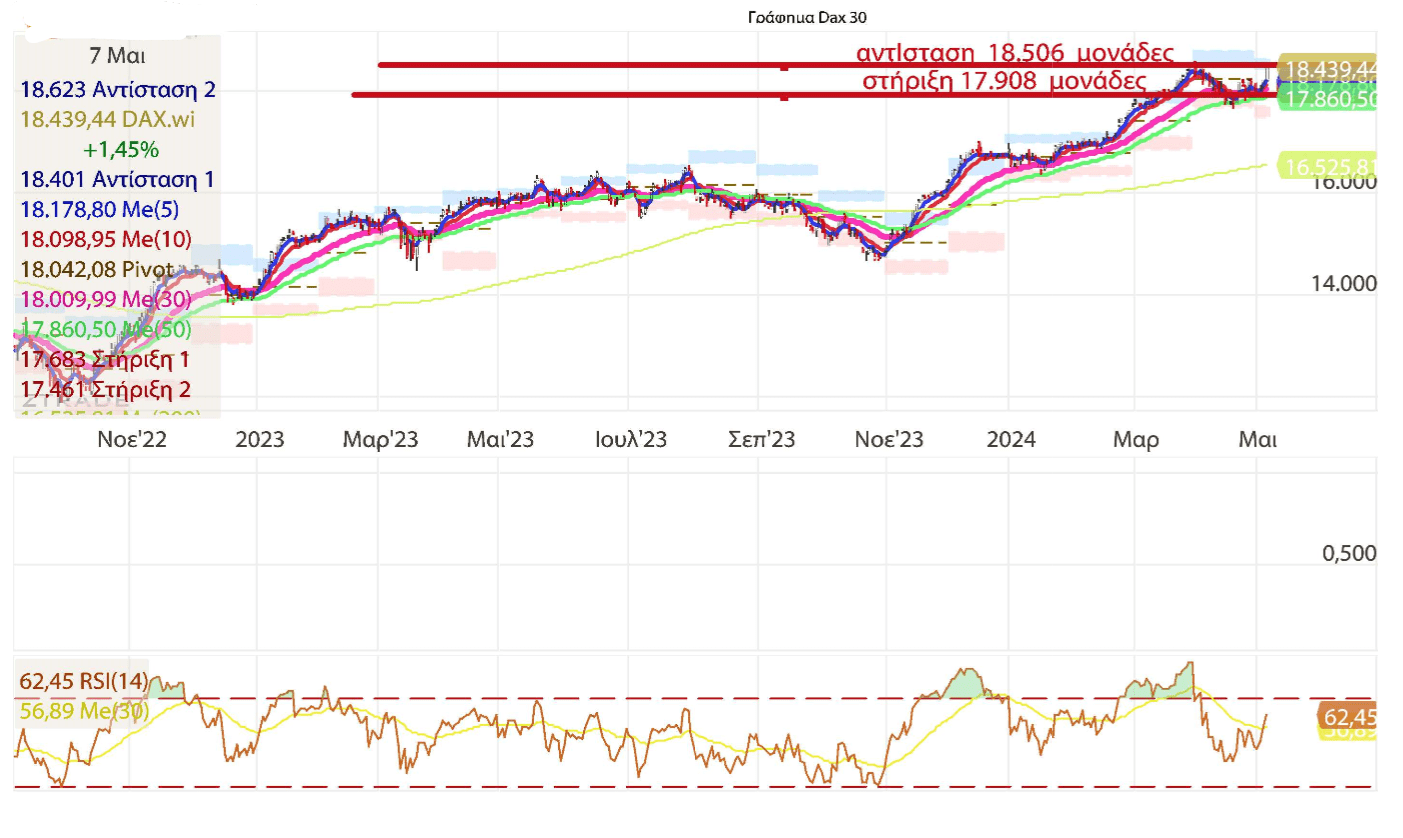

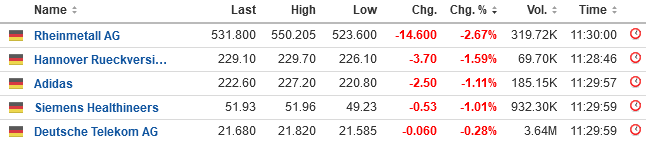

Στην Φρανκφούρτη ο δείκτης DAX έκλεισε στις 18.432 μονάδες με άνοδο 1,43%, με το σήμα να παραμένει σε strong buy, και με την αντίσταση να βρίσκεται στις 18.506 μονάδες και την στήριξη στις 17.908 μονάδες.

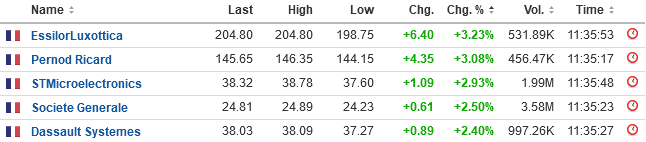

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

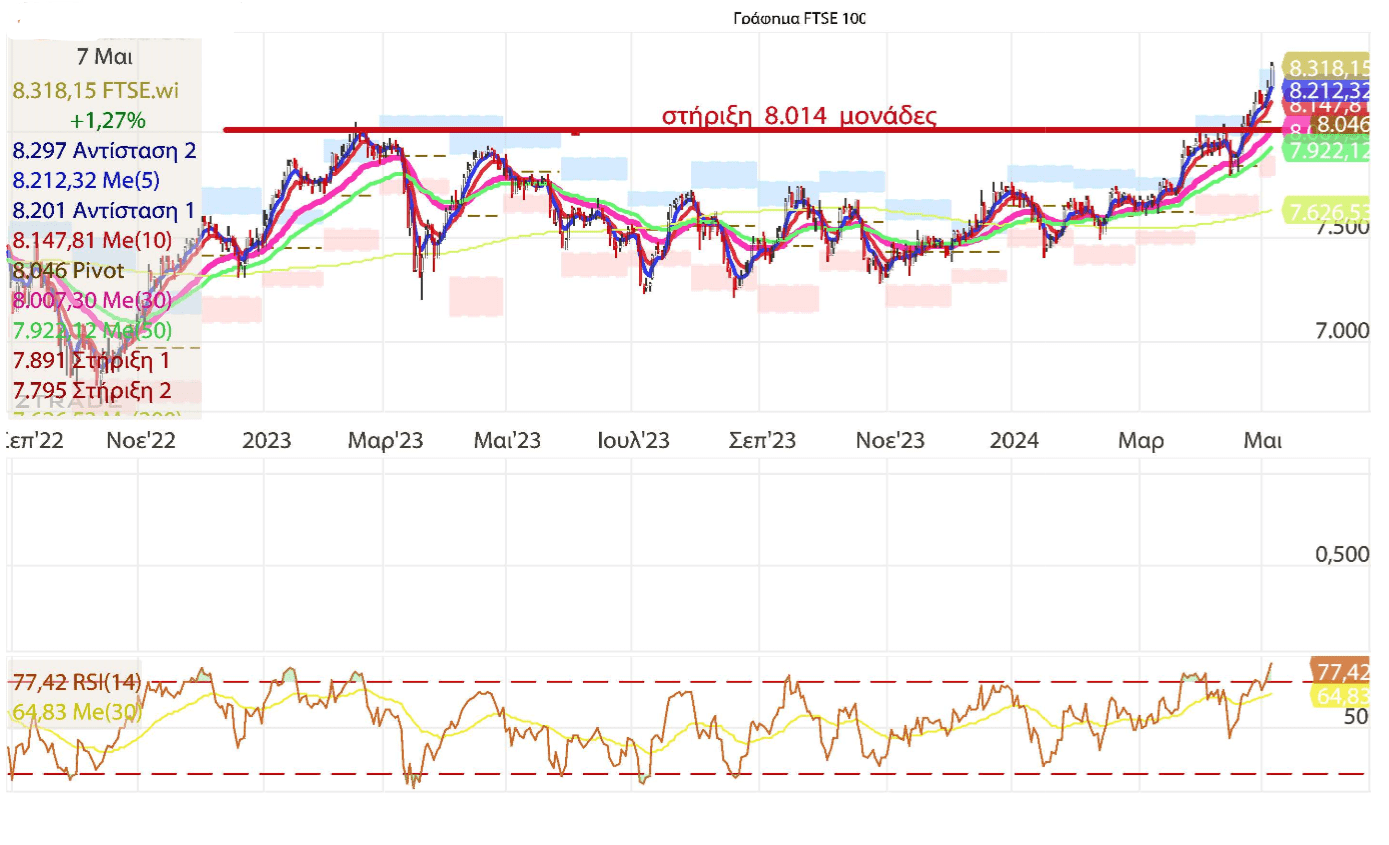

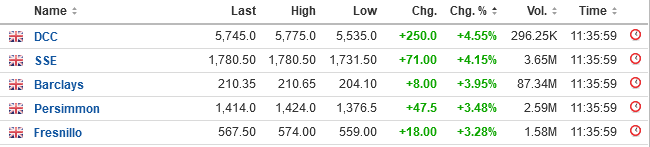

Στο Λονδίνο ο δείκτης FTSE 100 έκλεισε στις 8.312,06 μονάδες με άνοδο 0,49%, σημειώνοντας ενδοσυνεδριακά νέο ιστορικό υψηλό στις 8.335,94 μονάδες, με το σήμα να διατηρείται σε strong buy, και με την στήριξη να βρίσκεται στις 8.014 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

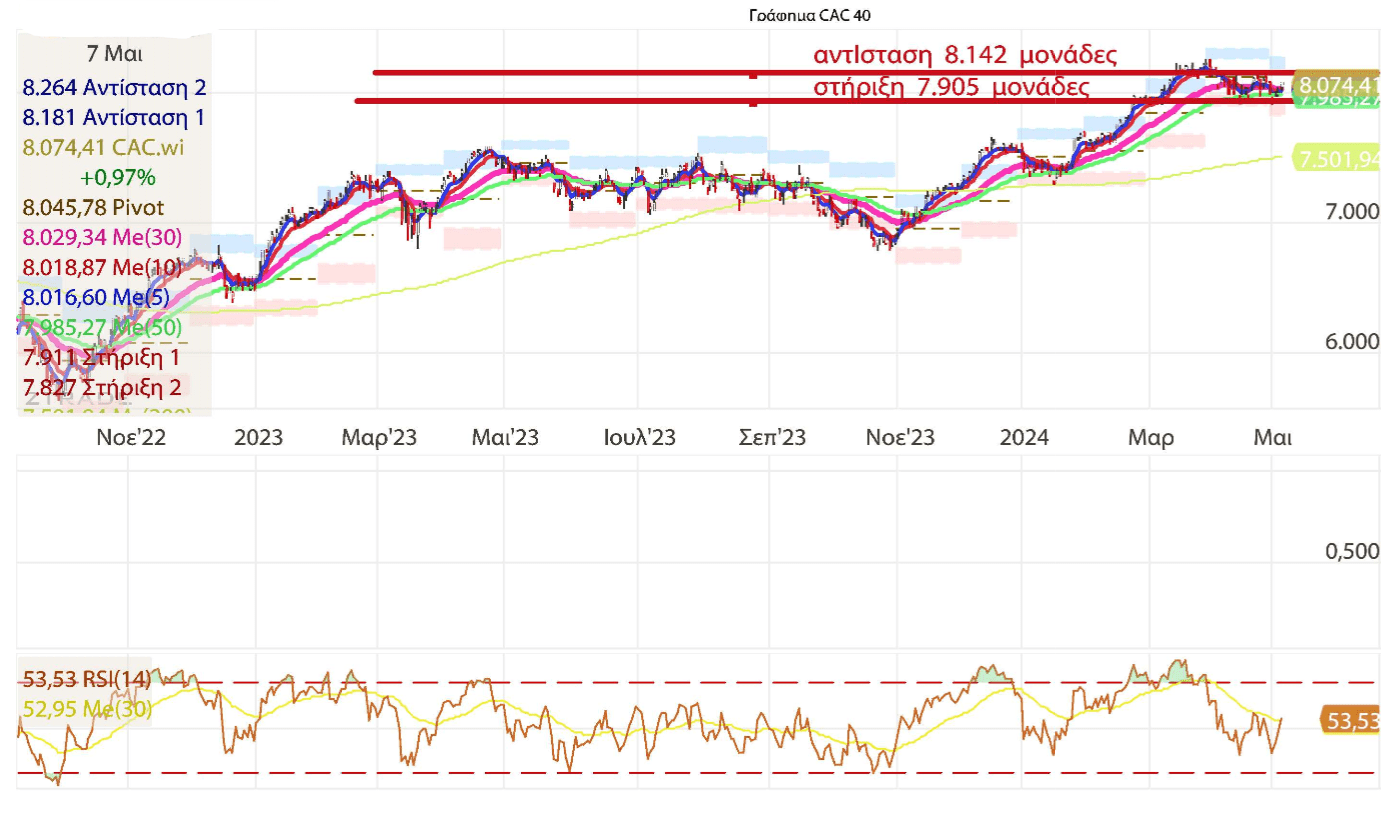

Στο Παρίσι ο δείκτης CAC 40 έκλεισε στις 8.075,68 μονάδες με άνοδο 0,99%, με το σήμα να μετατρέπεται σε strong buy από neutral, και με την αντίσταση να βρίσκεται στις 8.142 μονάδες και την στήριξη στις 7.905 μονάδες.

Μεγαλύτερη άνοδος

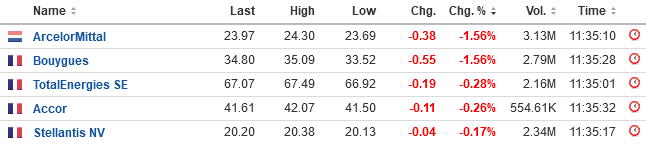

Μεγαλύτερη πτώση

Recommendations

Philips: Jefferies is negative on the stock with a Sell rating. The target price is being increased from EUR 17.50 to EUR 22.00.

Heidelberg Materials: Glynis Johnson from Jefferies retains his positive opinion on the stock with a Buy rating. The target price is unchanged and still at EUR 120.

Siltronic: Harry Blaiklock from UBS retains his negative opinion on the stock with a Sell rating. The target price is lowered from EUR 74 to EUR 67.

Daimler Truck: Already positive, the research from Jefferies and its analyst Michael Aspinall still consider the stock as a Buy opportunity. The target price is set at 56 versus 55 EUR.

Basler: In a research note published by Martin Comtesse, Jefferies advises its customers to buy the stock. The target price is unchanged at EUR 15.

Aixtron: The research of UBS is increasing its opinion on the stock. The broker’s advice is neutral against selling initially. The target price is decreased from EUR 24.60 to EUR 21.90.

Εταιρικά νέα

BP’s first-quarter profit was hit by lower prices for oil and gas sold, missing market forecasts, but the British energy company confirmed a $1.75 billion share buyback.

The London-based oil-and-gas giant said Tuesday that underlying replacement-cost profit–a metric similar to net income its U.S. peers report–was $2.72 billion, a marked decline from $4.96 billion in the same quarter last year. This missed a forecast of $2.87 billion, according to a company-compiled estimate from 24 analysts.

The result was driven by lower prices for oil and gas sold, the impacts of the outage at the Whiting refinery in Indiana and significantly weaker fuels margin. Stronger oil trading and higher realized refining margins only partially offset this.

The company produced 7.6% more hydrocarbons with 1.46 million barrels of oil-equivalent barrels a day, while gas and low-carbon energy output fell 5.7% to 914,000 BOE a day through the quarter.

BP’s replacement-cost before interest and tax–another closely watched metric–fell to $4.82 billion from $13.23 billion a year prior, missing the $5.83 billion forecast by consensus. The main contribution came from the oil production and operations segment with $3.06 billion, while the gas and low-carbon energy business accounted for $1.04 billion. Both units missed consensus’ forecasts.

BP is the last of the European energy companies to report first-quarter results. London-based rival Shell and European peers, such as TotalEnergies and Eni, all beat market expectations after pumping out more oil and gas shielded earnings from weak gas prices. In the quarter, BP generated a surplus cash flow of $5.0 billion, supporting a $1.75 billion share buyback until July 30.

In addition to the buyback, it declared a dividend payout of 7.27 cents, matching the payout in the two preceding quarters.

Looking ahead, BP expects its upstream production–the extraction of crude oil and gas–to fall in the second quarter compared to the first. For the full year, its expects production to rise slightly from last year’s output, driven by higher oil output offsetting a lower gas and low-carbon result.

UBS Group beat expectations with a return to net profit for the first quarter after posting losses for the prior two quarters, and said its integration of Credit Suisse is on track.

Nearly a year after the Swiss banking giant completed its rescue takeover of Credit Suisse under the auspices of Swiss authorities, UBS’s first-quarter results showed the absorption of its former rival still influences its performance.

The drag on UBS’s performance, however, was less severe than anticipated by analysts last quarter and the group continued to attract funds from wealthy clients. Lower expenses related to the Credit Suisse takeover, coupled with cost savings, helped UBS make a net profit of $1.755 billion for the first three months of the year. This beat analysts’ expectations of $602 million, according to consensus estimates provided by the bank.

The result marked UBS’s return to profitability after reporting net losses for the previous two quarters and compared with a net profit of $1.03 billion for the same period last year. Credit Suisse integration costs came to $1.02 billion for the quarter, the bank said. This represented a significant decline from $1.75 billion and $2.00 billion in the two preceding quarters, respectively.

UBS achieved gross cost savings of about $1 billion in the quarter and exited positions in its so-called noncore and legacy business, reducing the unit’s risk-weighted assets by $16 billion. Looking ahead, UBS said it expects integration-related expenses of around $1.3 billion in the second quarter. In February, UBS said two-thirds of integration costs were still ahead of it, with bills expected to keep arriving until 2026.

The group expects to complete a merger of the two banks’ key operating units, UBS AG and Credit Suisse AG, by the end of May. It also aims to transition to a single U.S. intermediate holding company by the end of June and to combine UBS and Credit Suisse’s Swiss businesses in the third quarter.

UBS said the mergers of its significant legal entities will pave the way for further cost savings and other benefits and allow it to start to move clients from old Credit Suisse platforms on to UBS systems in the second half.

The group ended the quarter with 111,549 internal personnel employed, down from 112,842 people at the end of 2023. The results came after Switzerland last month outlined a proposal to substantially hike the capital levels the bank is required to keep. The Swiss cabinet’s proposal didn’t specify how much extra capital UBS would need, but analysts have said the new rules could constrain UBS’s ability to return capital to shareholders.

UBS said it will only be able to fully assess the impact of the proposals once details of their implementation emerge, given the broad range of possible outcomes.

UBS booked $27 billion in net new assets into its key global wealth management business in the first quarter, it said. Group revenue for the quarter was $12.74 billion, up from $8.74 billion. On an underlying basis, UBS’s pretax profit rose to $2.62 billion from $1.57 billion.

Analysts expected revenue to be $11.95 billion, integration-related expenses at $1.12 billion and underlying pretax profit at $1.51 billion, according to the bank-compiled consensus.

The bank said it expects a decline in net interest income in its global wealth management business in the low-to-mid single-digit percentage range in the second quarter, with a drop of low-to-mid single digits in net interest income in its personal and corporate banking unit.

Richemont said it has reached an agreement to acquire 100% of Italian jewelry house Vhernier in a private transaction.

The Swiss luxury group on Tuesday said the transaction won’t have a material financial impact on its consolidated net assets or operating result for the year ending in March and that Vhernier’s results will be reported under the Jewellery Maisons business area. Financial details weren’t disclosed.

On the occasion of the state visit to France by the President of the People’s Republic of China, TotalEnergies (Paris:TTE) (LSE:TTE) (NYSE:TTE), represented by Patrick Pouyanné, Chairman and CEO, and China Petroleum and Chemical Corporation (“SINOPEC“), represented by Ma Yongsheng, Chairman, signed a strategic cooperation agreement to deepen their collaboration, notably in low-carbon energies.

TotalEnergies and SINOPEC have been working together for many years, notably in Angola and Brazil in Upstream operations, and more generally in various domains such as oil, LNG, oil product trading, and engineering. Recently, the companies have joined forces to develop a 230,000 tons per year sustainable aviation fuel (SAF) production unit at a SINOPEC refinery in China.

This strategic cooperation agreement aims to further develop the partnership between TotalEnergies and SINOPEC and seize new opportunities by leveraging their respective expertise. In particular, the two companies plan to combine their R&D expertise in biofuels, green hydrogen, CCUS and decarbonization.

“We are pleased to reinforce our partnership with SINOPEC, a major Chinese energy player which is already our partner in several countries. This strategic cooperation agreement reflects our shared will to combine our multi-energies expertise to address today’s growing global demand, while simultaneously building the decarbonized energy system of tomorrow, ” said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

“SINOPEC and TotalEnergies have established a strong partnership. Signing this strategic cooperation framework agreement on TotalEnergies’ 100(th) anniversary marks another milestone. Over the years, the two companies have carried out extensive cooperation in exploration and production, LNG, biofuels, and trading. With this agreement, both companies intend to strengthen the partnership by exploring more opportunities in the fields of sustainable aviation fuel, green hydrogen, CCUS, etc., to fulfil our commitment to low-carbon, green and sustainable growth of the industry,” added Dr. Ma Yongsheng, Chairman of SINOPEC.

DHL owner Deutsche Post posted an earnings decline in the first three months of the year as geopolitical tensions, inflation and high interest rates continued to drag on global trade, but said things should improve in the second half of the year as it backed full-year guidance.

The German logistics group, also known as DHL Group, on Tuesday reported an 18% drop in first-quarter net profit that came in just above expectations.

“As expected, a broad and dynamic economic upturn failed to materialize in the first three months of the year,” it said. “DHL Group continues to expect more positive global economic momentum in the second half of 2024.”

Volumes in the company’s key Express business have struggled to recover since the end of the pandemic as customers have reacted to slower demand by utilizing inventory already held in stock rather than ordering new, which has dented demand.

In the freight forwarding business, although air and ocean volumes are ticking higher, freight rates have normalized, which is pressuring revenue, it added. In response, DHL has focused on containing costs and lifting prices to protect profit, ahead of what it expects will be pick up in the global economy during the second half of the year.

Deutsche Post previously cautioned that it expected volumes to decline further in some markets in the first half of the year, sending earnings lower, before a pick-up in global economic momentum is expected to send earnings higher in the second half. “We are in an unusually long phase of low momentum in global trade,” Chief Executive Tobias Meyer said. “In this environment, we continue to focus on consistent capacity and cost management.”

Deutsche Post said earnings before interest and tax fell to EUR1.31 billion in the quarter from EUR1.64 billion a year before, in line with a company-compiled consensus of EUR1.28 billion. Net profit fell to EUR743 million versus the EUR721 million consensus expected, as revenue fell 3.2% to EUR20.25 billion, just below the expected EUR20.44 billion.

The company still expects EBIT in 2024 to reach between EUR6 billion and EUR6.6 billion, rising to EUR7.5 billion-EUR8.5 billion in 2026. It posted EBIT of EUR6.35 billion in 2023 and a company-compiled consensus expects 2024 EBIT at EUR6.23 billion.

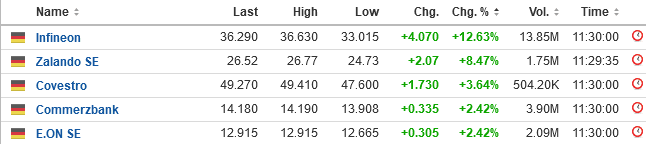

Infineon Technologies lowered its sales forecasts for fiscal 2024 for the second time this year as it grapples with slower growth in the automotive sector.

The German chip maker said Tuesday that it is aiming for around 15.1 billion euros ($16.26 billion) plus or minus EUR400 million in sales for the year ending in September, down from EUR16.31 billion of fiscal 2023. Its segment result margin–a key profitability metric–is expected at around 20% compared with 27% in fiscal 2023. The group had previously guided for roughly EUR16 billion in revenue and a segment result margin in the low to mid-20s percentage range.

The company reported revenue of EUR3.63 billion for its fiscal second quarter through the end of March compared with EUR4.12 billion a year earlier.

Net profit fell to EUR394 million from EUR826 million, while its segment result dropped to EUR707 million from EUR1.18 billion, generating a 19.5% segment result margin. Analysts had forecast revenue of nearly EUR3.60 billion and a net profit of EUR397.34 million, with a segment result of EUR647.67 million, according to consensus estimates compiled by Visible Alpha.

Uniper confirmed its 2024 expectations after posting a sharp drop in both income and sales due to robust comparatives.

The German gas importer on Tuesday said net income for the first quarter was 477 million euros ($513.7 million) from EUR6.75 billion in the same period a year ago.

Sales nearly halved to EUR17.98 billion from EUR34.209 billion. The company said the drop was related to though comparatives, as in 2023 it had benefited from the reversal of provisions for anticipated losses from procurement of replacement volumes of gas.

The company added that adjusted earnings before interest, taxes, depreciation and amortization–which strips out exceptional and other one-off items–came in at EUR885 million from EUR991 million.

Uniper said it continues to expect lower earnings in 2024, with adjusted net income anticipated to be in a range of between EUR700 million and EUR1.10 billion, down from EUR4.43 billion in 2023. Adjusted Ebitda is guided to be in the range of EUR1.50 billion to EUR2.00 billion, compared with EUR7.16 billion.

A company-compiled market consensus forecasts a drop in adjusted net income to EUR1.29 billion and adjusted Ebitda to EUR2.55 billion. The consensus was based on the estimate of seven analysts as of Jan. 15.

Bouygues reported a widened net loss for the first quarter despite a rise in revenue, and reiterated its outlook for the full year.

The French construction, media and telecommunications group said Tuesday that its net loss for the quarter was 146 million euros ($157.2 million) compared with a loss of EUR134 million in the same period last year. The result included net noncurrent charges of EUR42 million, which the company said don’t reflect the performance of its business segments and that relate in part to a management-incentive plan at its Equans business.

Current operating profit from activities rose to EUR26 million from EUR9 million, Bouygues said.

Revenue for the quarter grew to EUR12.31 billion from EUR12.01 billion.

The company reiterated its group-level guidance for 2024, which calls for slightly higher sales and current operating profit from activities compared with 2023.

UniCredit lifted its 2024 guidance as it reported better than expected profit for the first quarter of the year.

The Italian bank on Tuesday reported a net profit of 2.56 billion euros ($2.75 billion) for the first three months of 2024, up from EUR2.06 billion in the same period a year before.

Revenue climbed 7.4% on year to EUR6.37 billion, with net interest income–the difference between what lenders earn from loans and pay for deposits–rising 8.5% and fees and trading revenue up 3.3% and 20.4%, respectively.

Analysts on average expected UniCredit to report a net profit of EUR2.13 billion on revenue of EUR5.94 billion, according to consensus estimates provided by the bank.

UniCredit said it upgraded its net profit guidance for the year to be over EUR8.5 billion, from “broadly in line with 2023” previously and in line with consensus’ EUR8.51 billion estimate. The group also raised its distribution outlook and expects 2024 to be in line with 2023 for which it paid EUR8.6 billion–or 100% of its net profit–out to shareholders. The lender reiterated that it would boost shareholder distributions to EUR10 billion for the calendar year.

Heidelberg Materials posted lower first-quarter results but confirmed its 2024 outlook on positive price momentum in core markets offsetting a decline in sales volumes.

The German building materials group on Tuesday said its results from current operations before depreciation and amortization–the company’s preferred metric–for the three months ended March was 542 million euros ($583.7 million) compared with 557 million in the prior-year period.

Its results from current operations, or RCO, fell to EUR232 million from EUR258 million.

Revenue amounted to EUR4.49 billion, dropping from EUR4.90 billion largely due to a decrease in volumes in all group areas, which were partially offset by price adjustments, the company said.

Analysts saw revenue at EUR4.78 billion, results from current operations at EUR223 million, and results from current operations before depreciation, amortization at EUR535 million, according to consensus estimates collected by the company and compiled by Vara Research.

For 2024, the company backed its outlook and continues to target results from current operations ranging between EUR3.0 billion and EUR3.3 billion, as well as a return on invested capital around 10%. Heidelberg Materials continues to expect demand in construction sector to increasingly stabilize at a low level, it said.

Zalando backed its full-year guidance after it said it swung to operating profit in the first quarter, despite declining revenue and active customers.

The German fashion retailer posted adjusted earnings before interest and taxes of 28.3 million euros ($30.5 million) in the first three months of 2024, after a loss of around EUR700,000 in the same period of last year.

Zalando still posted a net loss of EUR8.9 million, compared with a EUR39 million loss for the same prior-year period. Revenue edged down 0.6% on year to EUR2.24 billion, as active customers declined to 49.5 million, from 51.2 million in the same quarter of 2023.

But the DAX-listed company confirmed its full-year guidance, expecting adjusted EBIT between EUR380 million and EUR450 million and both gross merchandise volume and revenue to grow between 0% and 5% this year compared with 2023. Group gross merchandising volume was up 1.3% on year in 1Q, to EUR3.27 billion.