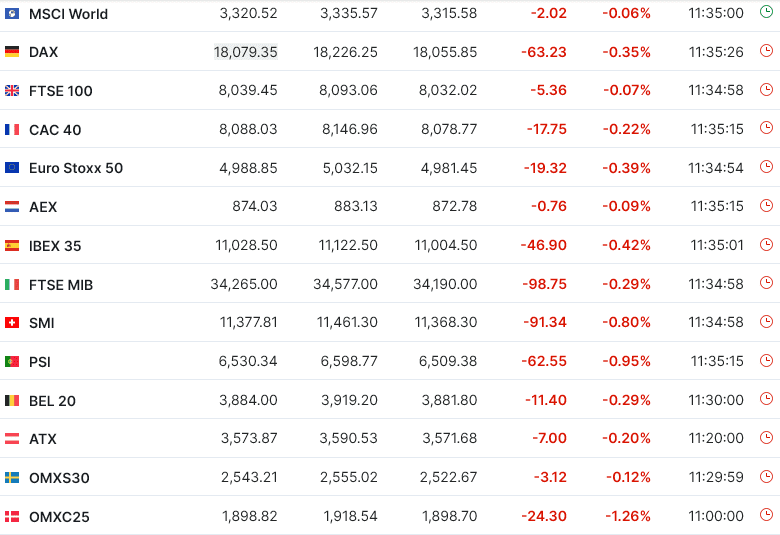

Με αρνητικό πρόσημο έκλεισαν σήμερα τα περισσότερα ευρωπαϊκά χρηματιστήρια, με τον κλάδο τεχνολογίας να πραγματοποιεί τα μεγαλύτερα κέρδη και αυτόν των πρώτων υλών τις μεγαλύτερες απώλειες.

Ρευστοποιήσεις επικράτησαν σήμερα στα περισσότερα ευρωπαϊκά χρηματιστήρια, με τους επενδυτές να προβαίνουν σε κατοχύρωση κερδών μετά την άνοδο των προηγούμενων ημερών, επηρεαζόμενοι και από τις εταιρικές ανακοινώσεις οικονομικών αποτελεσμάτων πρώτου τριμήνου οι οποίες ήταν κατώτερες των εκτιμήσεων.

Ο πληθωρισμός στην ευρωζώνη μπορεί να αποδειχθεί ακόμη επίμονος, οπότε η μείωση των επιτοκίων της Ευρωπαϊκής Κεντρικής Τράπεζας (ΕΚΤ) τον Ιούνιο δεν θα ακολουθηθεί απαραίτητα από περαιτέρω χαλάρωση της πολιτικής, δήλωσε την Τετάρτη ο πρόεδρος της Bundesbank Joachim Nagel.

Η ΕΚΤ έχει ουσιαστικά υποσχεθεί μείωση των επιτοκίων στην επόμενη συνεδρίασή της στις 6 Ιουνίου, αλλά οι υπεύθυνοι χάραξης πολιτικής εξακολουθούν να συζητούν για την πορεία των επιτοκίων πέραν αυτής και τα μηνύματα από την Ομοσπονδιακή Τράπεζα των ΗΠΑ ότι η δική της χαλάρωση θα μπορούσε να καθυστερήσει, θολώνουν περαιτέρω τις προοπτικές. (περισσότερα εδώ)

Στα κυριότερα μακροοικονομικά νέα:

Στην Γερμανία, ο δείκτης Επιχειρηματικών Προσδοκιών για τον μήνα Απρίλιο ανήλθε στις 89,9 μονάδες έναντι εκτιμήσεων των εκτιμήσεων 88,9 μονάδες και 87,7 μονάδες τον προηγούμενο μήνα (αναθεωρημένο από τις 87,5 μονάδες). Ο δείκτης Τρέχουσας Κατάστασης για τον μήνα Απρίλιο ανήλθε στις 88,9 μονάδες έναντι εκτιμήσεων των εκτιμήσεων 88,7 μονάδες και 88,1 μονάδες τον προηγούμενο μήνα. Ο δείκτης Επιχειρηματικού Κλίματος για τον μήνα Απρίλιο ανήλθε στις 89,4 μονάδες έναντι εκτιμήσεων των εκτιμήσεων 88,9 μονάδες και 87,9 μονάδες τον προηγούμενο μήνα (αναθεωρημένο από τις 87,8 μονάδες).

Η γερμανική κυβέρνηση προέβη στην έκδοση ομολόγου δεκαετούς διάρκειας με κουπόνι 2,54% έναντι 2,38% της αντίστοιχης προηγούμενης έκδοσης.

Ο δείκτης Stoxx 600 έκλεισε στις 505,42 μονάδες με πτώση 0,47%.

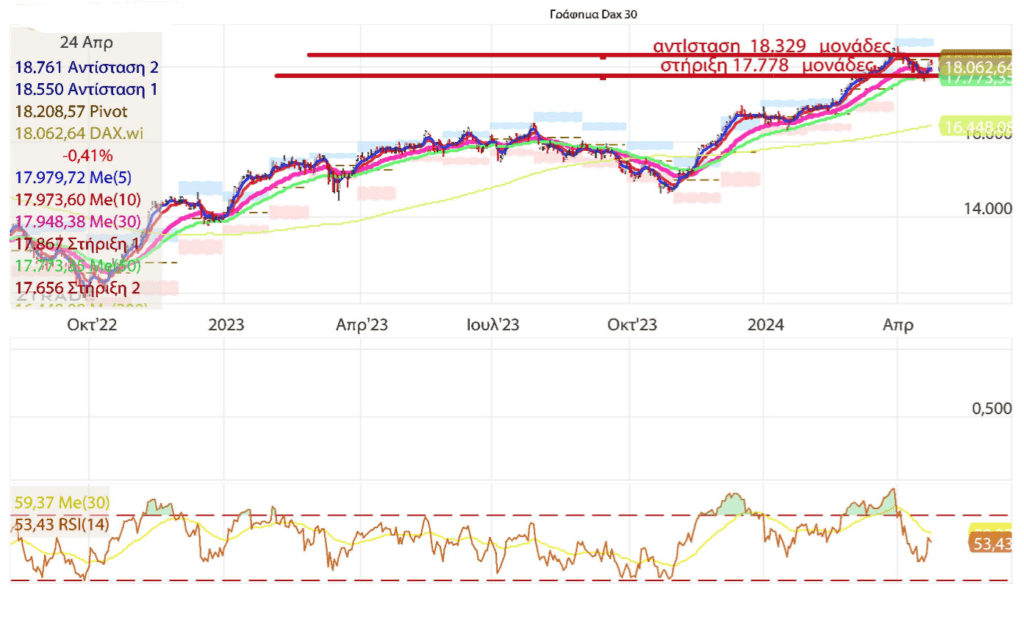

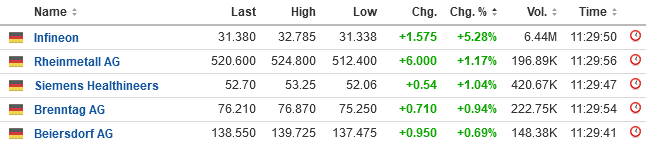

Στην Φρανκφούρτη ο δείκτης DAX έκλεισε στις 18.079,35 μονάδες με πτώση 0,35%, με το σήμα να μετατρέπεται από strong buy σε buy, και με την αντίσταση να βρίσκεται στις 18.329 μονάδες και την στήριξη στις 17.778 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

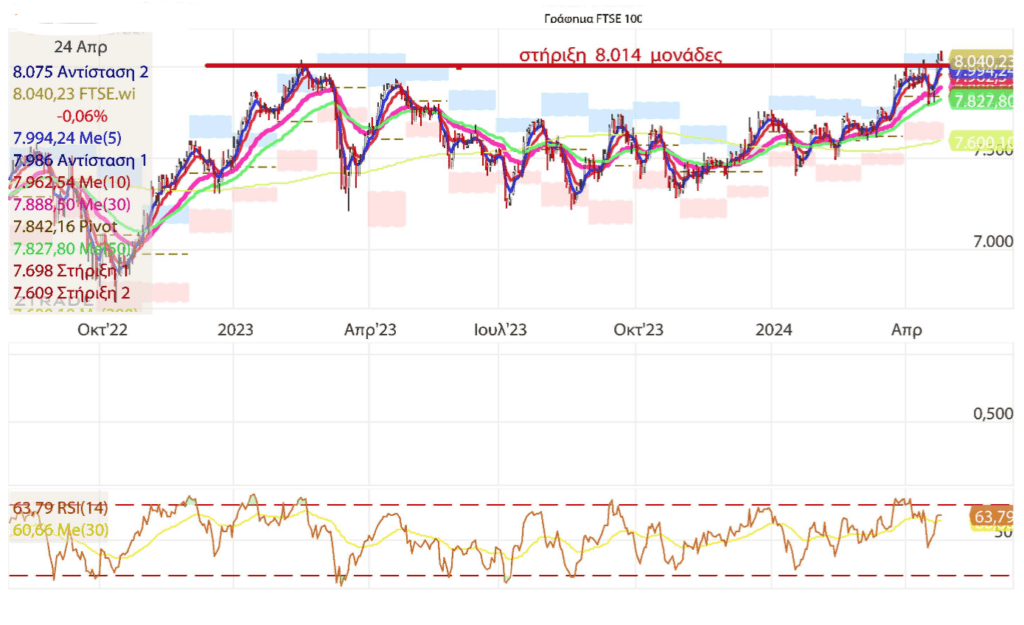

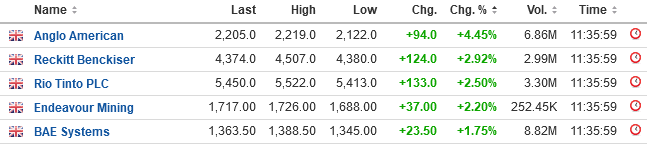

Στο Λονδίνο ο δείκτης FTSE 100 έκλεισε στις 8.039,45 μονάδες με οριακές απώλειες 0,07%, πραγματοποιώντας ενδοσυνεδρικά ιστορικό υψηλό στις 8.093,06 μονάδες, με το σήμα να διατηρείται σε strong buy, και με την στήριξη να βρίσκεται στις 8.014 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

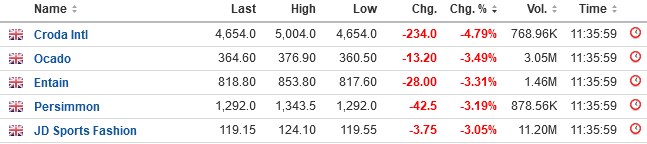

Στο Παρίσι ο δείκτης CAC 40 έκλεισε στις 8.088,03 μονάδες με πτώση 0,22%, με το σήμα να διατηρείται σε strong buy, και με την αντίσταση να βρίσκεται στις 8.142 μονάδες και την στήριξη στις 7.905 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

Recommendations

Kering: In his latest research note, analyst Louise Singlehurst confirms his recommendation. The broker Goldman Sachs is keeping its Neutral rating. The target price has been revised downwards and is now set at EUR 310 as compared to EUR 372 previously.

Deutsche Boerse: Goldman Sachs analyst Oliver Carruthers maintains his Neutral opinion on the stock. The target price is still set at EUR 207.

AKZO NOBEL: JP Morgan less pessimistic on the stock and revises its recommendation upwards and now adopts a neutral opinion. The target price has been modified and is now set at EUR 70 compared to EUR 68.50.

Deutsche Boerse: JP Morgan analyst Enrico Bolzoni maintains his Neutral opinion on the stock. The target price remains set at EUR 198.

Deutsche Boerse: Jefferies’s research confirms his advice and maintains his neutral opinion on the stock. The target price is still set at EUR 195.

Εταιρικά νέα

Roche first-quarter sales declined amid weak demand for Covid-19 products and currency headwinds but slightly beat analysts expectations.

The Swiss pharmaceutical giant said Wednesday that sales dropped to 14.39 billion Swiss francs ($15.79 billion) for the first quarter, from CHF15.32 billion in the same quarter a year prior. Analysts had estimated sales at CHF14.35 billion, according to a Visible Alpha compiled consensus.

Sales in the pharmaceutical and diagnostics divisions both fell 6% to CHF75.8 billion and CHF24.2 billion, respectively, the company said. Sales related to Covid-19 tests dropped to CHF100 million in the first quarter, down from CHF300 million a year before, as booming demand for Covid-19 medicine Ronapreve and tests waned.

Roche said this quarter was the last to be hit by pandemic-related sales decline. Foreign-exchange rates also hurt sales, and Roche said its revenue growth on-year was 2%, when measured at constant currency. Roche backed its full-year guidance and expects to further increase its dividend.

Volvo Car expects demand for its cars to remain robust in the coming quarters and still sees retail sales growth increasing this year.

The Swedish auto maker said retail sales rose 12% in the quarter, after booking a monthly sales record in March thanks to strength in Europe and the U.S. Retail sales of the company’s electric vehicles increased 11% on the year and their profitability also continued to rise. The gross margin of its battery-powered vehicles rose to 16% from 7% in the same quarter last year as raw material costs fell further and the company launched its EX30 electric SUV.

The overall group operating margin excluding joint ventures and associates rose to 7.2% from 6.6%. Following the end of the quarter, Volvo began distributing 62.7% of its Polestar stake to its shareholders. It said earlier this year that it would pare down the stake in the EV maker it founded with its Chinese owner Geely to 18% and stop providing further funding.

The company posted a net profit attributable to shareholders of 3.34 billion Swedish kronor ($308.9 million) from SEK3.61 billion a year earlier, as revenue fell 1.9% to SEK93.88 billion. Analysts polled by FactSet saw net profit at SEK4.22 billion on revenue of SEK99.95 billion.

Royal KPN reported a fall in net profit mainly due to one-off refinancing cost that offset higher revenue, and raised its full-year guidance.

The Dutch telecommunications company said Wednesday that net profit for the first quarter was 175 million euros ($187.3 million) compared with EUR196 million for the same period a year earlier. Consensus expected EUR200 million based on two forecast taken from FactSet. KPN’s adjusted earnings before interest, taxes, depreciation, amortization and the cost of leased assets, or Ebitdaal–the company’s preferred metric, that strips out exceptional and other one-off items–rose to EUR605 million from EUR584 million.

Adjusted revenue rose to EUR1.38 billon from EUR1.33 billion driven by continued group service revenue growth, in line with consensus of EUR1.38 billion based on five analysts forecasts taken from FactSet. Royal KPN raised its full-year guidance with adjusted Ebitda after leases of around EUR2.50 billion instead of EUR2.48 billion and free cash flow of EUR890 million instead of EUR880 million.

Air Liquide reported a fall in sales for the first quarter that was worse than analysts expected due to a drop in energy prices that the company passed through to its customers and currency headwinds.

The French supplier of industrial gases said Wednesday that revenue for the first quarter was 6.65 billion euros ($7.12 billion), down 7.3% compared with the same period last year. Analysts expected Air Liquide’s quarterly sales to come in at EUR6.73 billion, according to consensus estimates provided by Vara Research.

The company attributed the drop to a decline in energy prices as well as hit from foreign-exchange fluctuations. Changes in energy prices are contractually passed through to the company’s large industrial customers, it said.

On a comparable basis, excluding currency, energy and changes in the group’s footprint, the company’s revenue was up 2.1%, it said. Air Liquide said it remains confident in its ability to expand its operating margin and to deliver recurring net profit growth at constant exchange rates this year.

Orange delivered higher revenue for the first quarter, boosted by strong revenue growth in its Africa and Middle East division, and backed its full-year guidance.

The French telecommunications company said Wednesday that revenue for the quarter rose to 9.85 billion euros ($10.54 billion) from EUR9.65 billion for the same period a year earlier, missing a forecast of EUR10.79 billion based on two estimates taken from FactSet.

Revenue at its Africa and the Middle East division grew 11%, led by a robust performance in voice and double-digit increases in mobile data, fixed broadband, Orange Money and in B2B, despite the devaluation of the Egyptian pound, the company said. In Europe, revenue declined 2% due to a reduction in low-margin activities, offset partially by the continued growth of retail services excluding IT and integration services.

Earnings before interest, taxes, depreciation, amortization and the cost of leased assets, or Ebitdaal–the company’s preferred metric–rose to EUR2.41 billion from EUR2.35 billion. An estimate taken from FactSet had Ebitdaal at EUR2.69 billion. Orange backed its full-year guidance for low single-digit growth in Ebitda after leases and organic cash flow from telecom activities of at least EUR3.3 billion.

Skandinaviska Enskilda Banken posted a better-than-expected first-quarter net profit, driven by a sharp rise in income.

The Sweden-based bank posted net profit of 9.5 billion kronor ($878.7 million), up from SEK9.39 billion a year earlier and ahead of the SEK8.84 billion forecast from analysts polled by FactSet. Net interest income rose 4.1% to SEK11.77 billion, compared with an expected SEK12.12 billion.

“The strengthening macroeconomic picture in Sweden was partly reflected in an improved market sentiment,” Chief Executive Johan Torgeby said. “At the same time, the high interest rate environment continued to have a dampening effect on credit demand.”

SEB has an overall ambition to grow earnings per share and reach the long-term aspirational target of 15% return on equity. Its cost target for 2024 is below or equal to SEK29 billion, assuming average foreign-exchange rates during 2023. The bank’s common equity Tier 1 ratio–a key measure of financial strength–stood at 18.9% at the end of the quarter, down from 19.2% a year prior.

Svenska Handelsbanken’s first-quarter earnings missed expectations as costs rose faster than income.

The Swedish bank reported net profit of 6.6 billion Swedish kronor ($610.4 million), down from SEK6.81 billion a year earlier and a FactSet consensus forecast of SEK6.74 billion. Net interest income rose to SEK11.59 billion from SEK11.49 billion, against a forecast of SEK11.99 billion.

“In a quarter marked by expenses rising more quickly than income, we are naturally far from satisfied,” the bank said.

Handelsbanken said it will strengthen and extend the responsibilities undertaken by its decentralized business model to help enforce efficiency improvements.

Net interest income has been negatively affected by narrowing margins, but it said there has been good growth within the savings business and private banking. Staff costs are rising, but part of the increase is due to additional recruitments in the branch operations from increasing customer and business activity, it added. Handelsbanken’s common equity Tier 1 ratio–a measure of financial strength–was at 18.8%, down from 19.4%.