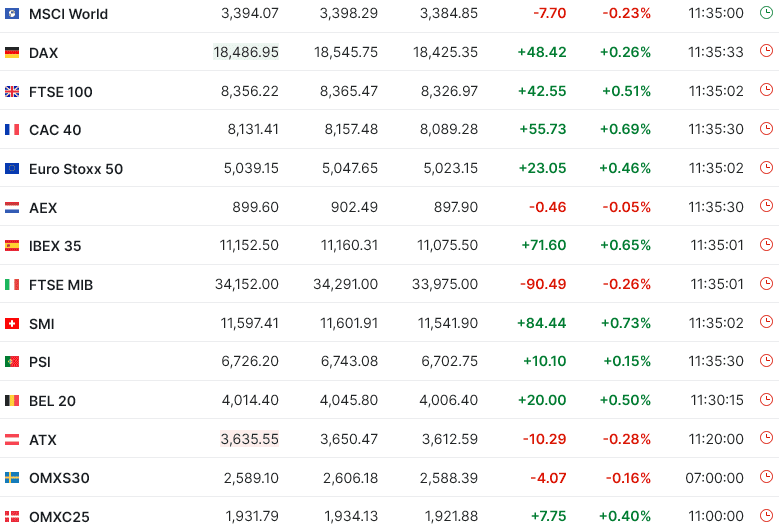

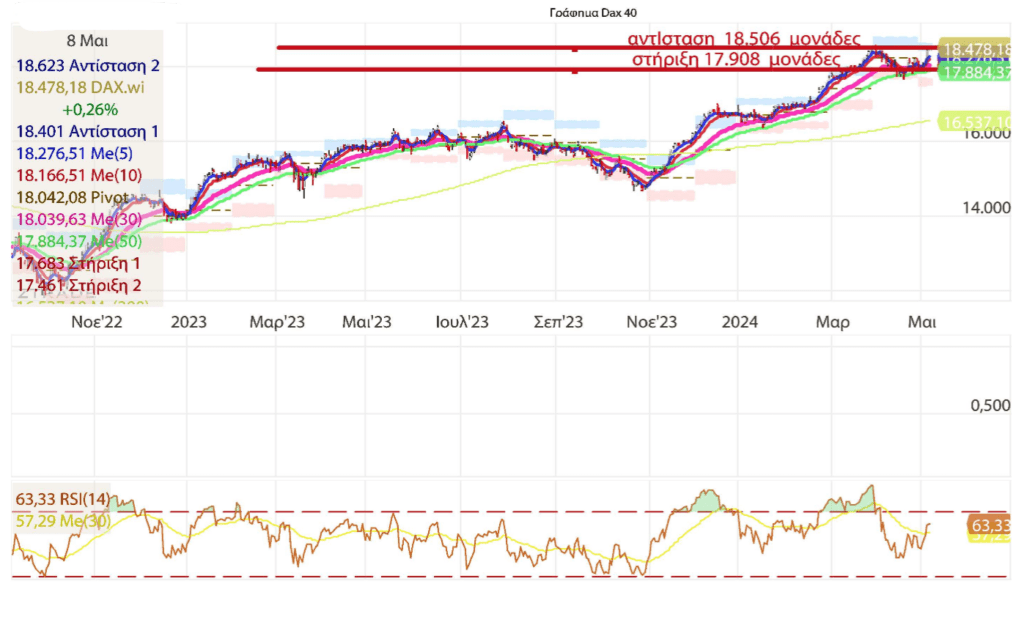

Θετικά πρόσημα επικράτησαν και σήμερα στα περισσότερα ευρωπαϊκά χρηματιστήρια, με τον κλάδο τροφίμων και ποτών να πραγματοποιεί τα μεγαλύτερα κέρδη και αυτόν της εξόρυξης τις μεγαλύτερες απώλειες.

Διατηρείται το θετικό κλίμα περισσότερα στα ευρωπαϊκά χρηματιστήρια, με τους επενδυτές να συνεχίζουν να εμφανίζουν διάθεση για ρίσκο επηρεαζόμενοι από τα καλά εταιρικά οικονομικά αποτελέσματα των ευρωπαϊκών εταιρειών, αλλά των αυξημένων προσδοκιών για μείωση των επιτοκίων από την Ευρωπαϊκή Κεντρική Τράπεζα τον επόμενο μήνα.

Τα πρόσφατα στασιμοπληθωριστικά στοιχεία στις ΗΠΑ έχουν περιορίσει το εμπόριο αναθέρμανσης, ωθώντας τις χρηματιστηριακές αγορές να αναγνωρίσουν το περιβάλλον «υψηλότερων για μεγαλύτερο χρονικό διάστημα» επιτοκίων, ανέφεραν στρατηγικοί αναλυτές της Barclays την Τετάρτη.

Η τοποθέτηση είναι σαφέστερη μετά την υποχώρηση, αλλά όχι υπερβολικά καταθλιπτική, καθώς η μείωση του κινδύνου ήταν μέτρια. Ο συνδυασμός της προκλητικής εποχικότητας, των υπερεκτεταμένων κυκλικών κύκλων, της γεωπολιτικής αβεβαιότητας και της προσέγγισης της Federal Reserve που βασίζεται σε δεδομένα θα μπορούσε να «κρατήσει τις αγορές σε εγρήγορση μέχρι το καλοκαίρι», προειδοποίησε η Barclays. (περισσότερα εδώ)

Στα κυριότερα μακροοικονομικά νέα:

Στην Γερμανία, η βιομηχανική παραγωγή για τον μήνα Μάρτιο υποχώρησε 0,4% έναντι εκτιμήσεων των οικονομολόγων για πτώση 0,6% και αύξησης 1,7% τον προηγούμενο μήνα (αναθεωρημένο από το 2,1%).

Ο δείκτης Stoxx 600 έκλεισε στις 515,90 μονάδες με άνοδο 0,37%.

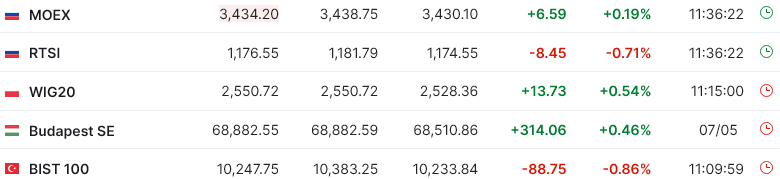

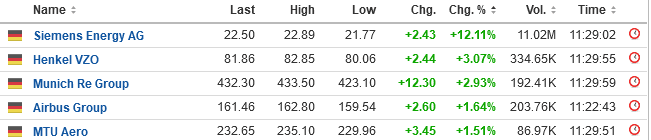

Στην Φρανκφούρτη ο δείκτης DAX έκλεισε στις 18.486,95 μονάδες με άνοδο 0,26%, με το σήμα να παραμένει σε strong buy, και με την αντίσταση να βρίσκεται στις 18.506 μονάδες και την στήριξη στις 17.908 μονάδες.

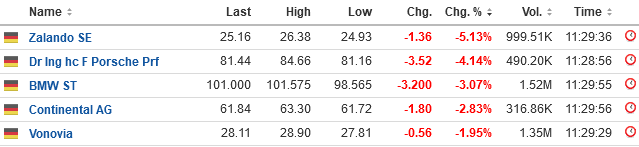

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

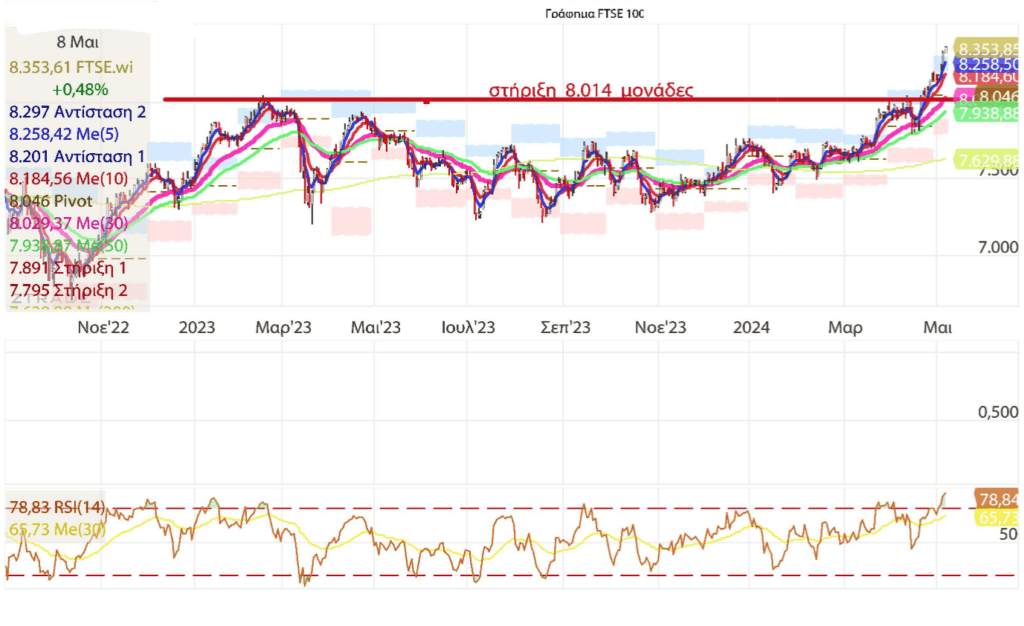

Στο Λονδίνο ο δείκτης FTSE 100 έκλεισε στις 8.356,22 μονάδες με άνοδο 0,51%, σημειώνοντας ενδοσυνεδριακά νέο ιστορικό υψηλό στις 8.365,47 μονάδες, με το σήμα να διατηρείται σε strong buy, και με την στήριξη να βρίσκεται στις 8.014 μονάδες.

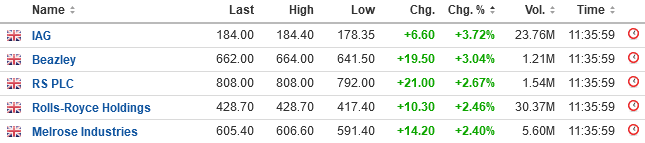

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

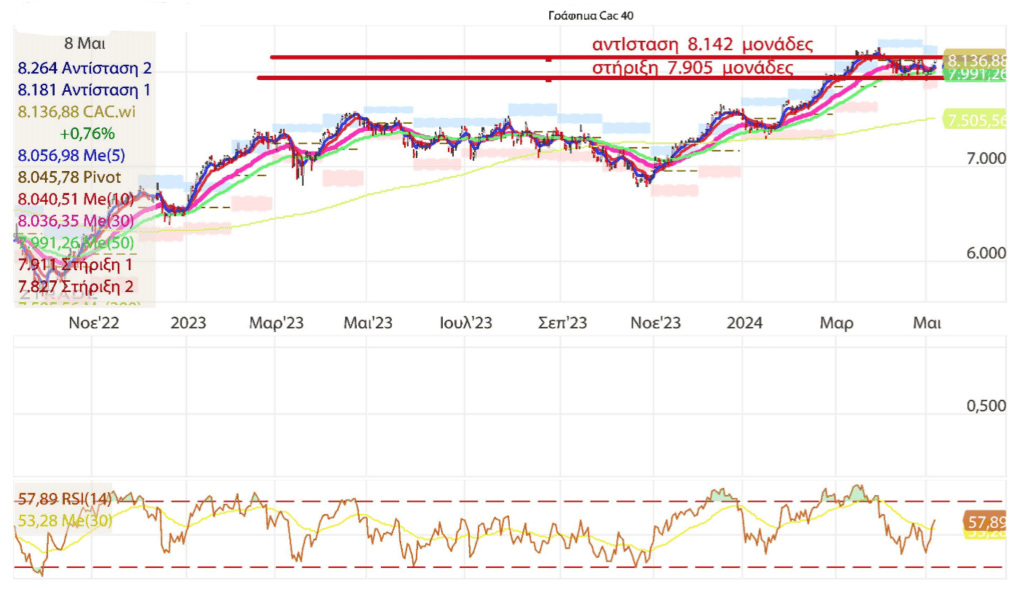

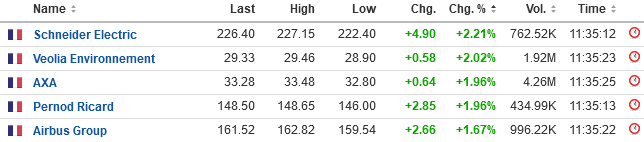

Στο Παρίσι ο δείκτης CAC 40 έκλεισε στις 8.131,41 μονάδες με άνοδο 0,69%, με το σήμα να παραμένει σε strong buy, και με την αντίσταση να βρίσκεται στις 8.142 μονάδες και την στήριξη στις 7.905 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

Recommendations

Evonik: Jefferies confirms his opinion on the stock and remains Neutral. The target price is still set at EUR 20.

Lanxess: In a research note, Jefferies analyst Chris Counihan has maintained his recommendation on the stock with a Neutral rating. The target price continues to be set at EUR 24.

Metro: Baader Bank analyst reiterate his Sell rating on the stock. The target price is unchanged and still at EUR 5.50.

Siemens Energy: In his latest research note, analyst Simon Toennessen confirms his recommendation. The broker Jefferies is keeping its Neutral rating. The target price continues to be set at EUR 20.

DHL: In a research note, Bernstein analyst Alexander Irving has maintained his recommendation on the stock with a Buy rating. The target price has been revised downwards and is now set at EUR 45.00 as compared to EUR 46.50 previously.

Lufthansa: Barclays’s analyst has raised his rating from Neutral to Buy. The target price has been raised to EUR 9.00 from EUR 7.30.

Εταιρικά νέα

Bertelsmann confirmed its forecast for 2024 after a drop in revenue for the first quarter due to last year’s sale of a stake in outsourcing company Majorel.

The German media group said revenue was 4.3 billion euros ($4.62 billion), down 9% compared with the same period last year.

On an organic basis, revenue grew 3.6%, with contributions from most of the group’s businesses, it said. “We confirm our forecast for the current year,” Bertelsmann Chairman and Chief Executive Thomas Rabe said.

The group said it continues to expect a significant decline in revenue and earnings due to asset sales, but a moderate increase in both revenue and earnings from continuing operations.

BMW’s key automotive unit reported slightly lower-than-forecast profitability in the first quarter as manufacturing costs rose, but the group maintained full-year guidance.

The German luxury-car maker’s operating margin was 8.8% in the division, short of a company-compiled consensus of 9.2%.

Deliveries of its BMW, Rolls-Royce, and Mini brands rose 1.1% to 594,533 units in the quarter, buoyed by sales of its BMW branded cars in Europe. Volumes declined in China though as demand for higher-end cars eased.

Higher sales volumes and more favorable mix from higher-priced cars and electric vehicles boosted automotive revenue, and it said prices across the product range this year are expected to be in line with last year’s level. The company has previously outlined expectations for its fully-electric vehicles and upper-premium range to drive growth this year as it invests heavily in its manufacturing plants, premium cars and technology to speed up electrification plans.

Research and development costs rose sharply in the quarter as it continued to spend on the electrification and digitalization of its vehicle fleet in addition to the continued development of automated driving functions and development of the Neue Klasse models.

“This year, it will be more important than ever to maintain our strategic course,” said Chief Financial Officer Walter Mertl. “The investments needed in the digital and electric future of our company are the highest they have ever been.”

BMW is embarking on a step change in its electric vehicle line-up with the Neue Klasse. The first models of the new range will debut in 2025 with a sports activity vehicle and a sedan, and a rapid rollout of further models planned afterwards. The launch of at least six Neue Klasse models across BMW’s global production network is scheduled to start within the first 24 months after the start of production. It said Wednesday that deliveries of fully-electric vehicles grew by 28% in the quarter to 83,000 cars.

The company’s group earnings before interest and tax margin slipped to 11.4% from 13.9%, but the figure still beat consensus that had been looking for 10.8%.

Group EBIT fell to 4.05 billion euros ($4.36 billion) from EUR5.38 billion a year earlier. A company-compiled consensus had seen EBIT at EUR3.96 billion. Revenue edged 0.6% lower to EUR36.61 billion.

The company still expects to see slight growth in worldwide customer deliveries in 2024, with the automotive EBIT margin finishing the year at between 8% and 10% and group pretax earnings falling slightly.

Puma reported a decline in first-quarter earnings after sales were hit by unfavorable currency effects.

The German sporting-goods company said it made 87.3 million euros ($93.9 million) in net profit for the period, compared with EUR117.3 million a year ago, on sales that fell 3.9% on year to EUR2.1 billion.

The company said that sales took a EUR100-million hit from adverse currencies effects. Puma, which previously said it expected muted consumer sentiment and volatile demand particularly in the first half this year, said that the market continued to be volatile and that its retail partners still had elevated stock levels.

That said, the company has begun to invest into its first brand campaign in a decade. The company said that it is expecting to achieve mid-single-digit currency-adjusted sales growth and an operating result in the range of EUR620 million to EUR700 million, up from EUR622 million for 2023.

It added that it expected its net income this year to change in line with its operating result.

Renishaw said third-quarter revenue rose as additive manufacturing grew strongly, and adjusted its outlook for the year.

The London-listed technology company said that for the three months ended March 31 revenue was 172.4 million pounds ($215.7 million) compared with GBP166 million the year before. For the nine-month period revenue was GBP502.9 million, down from GBP522 million before.

The company said manufacturing technologies revenue was 5% lower at reported exchange rates in the nine-month period with growth in its co-ordinate measuring machine and gauging systems sales in the industrial metrology area offset by lower revenue for position measurement products.

Pretax profit for the nine months to March was GBP86.8 million, down from GBP117.3 million. Adjusted pretax profit–which strips out exceptional and other one-off items–was GBP86.8 million, compared with GBP111.8 million.

The company adjusted its revenue guidance for the year to a GBP680 million to GBP700 million range from a previous GBP675 million to GBP715 million range. Adjusted pretax profit is now expected to be in the GBP122 million to GBP135 million range, down from a previous GBP122 million to GBP147 million range.

“We expect the recent improvement in our trading performance to strengthen in the remainder of the financial year, as market conditions improve and as we continue to realize the benefits from a range of targeted growth opportunities,” the company said.

Royal Ahold Delhaize NV on Wednesday backed its full-year outlook, as first-quarter sales rose slightly but its operating income dropped.

The Dutch grocer said its group operating income for the quarter fell 2.3% to 803 million euros ($863.7 million).

Net sales rose 0.4% to EUR21.73 billion from the same period of the prior year and compared with a consensus estimate of EUR21.53 billion provided by the company. Group net sales were driven by comparable sales growth excluding gasoline of 1.6% and the net opening of new stores, the company said.

U.S. net sales fell 0.6% to EUR13.25 billion, while European sales climbed 4.6% to EUR8.48 billion, the company said.

The company reiterated its 2024 outlook and continues to expect an underlying operating margin of 4% or higher, as well as underlying earnings per share at around 2023 levels.

The acquisition of Profi is expected to close in the second half of 2024, doubling the size of operations in Romania, but as the timing of the closing is uncertain, the outlook excludes any impact from transactions, it said.

Alstom reported a widened net loss for its fiscal year despite increases to sales and adjusted earnings.

The French train maker said its net loss for the year to March widened to 309 million euros ($332.3 million) from a loss of EUR132 million the year prior.

Sales rose 6.7% to EUR17.62 billion, while orders declined 8.4% to EUR18.95 billion. Adjusted earnings before interest and taxes–the company’s key metric–grew 17% to EUR997 million, while its margin expanded to 5.7% from 5.2%. The company said it is now ready implement its inorganic deleveraging plan of around EUR2 billion. The plan calls for around EUR700 million in divestments and a capital increase of around EUR1 billion to take place no later than September.

“The group is capitalizing on the solid operational progress made over the last three years and is launching new initiatives to improve its industrial performance and reduce overheads and indirect procurement costs,” Chief Executive Henri Poupart-Lafarge said.

Alstom said it wouldn’t propose a dividend for fiscal 2024. For fiscal 2025, the company expects to achieve an adjusted EBIT margin of around 6.5% and organic sales growth of around 5%.

Munich Re confirmed its net profit guidance for the year after reporting a much better-than-expected first quarter given below-average major-loss expenditure, better return on investment and good operational performance.

The German reinsurer on Wednesday posted net profit for the first three months of 2024 of 2.14 billion euros ($2.30 billion), in line with preliminary figures. This compares with EUR1.27 billion reported for the same period the previous year and beat estimates taken from a company-compiled consensus of EUR1.48 billion.

Insurance revenue from insurance contracts issued increased to EUR15.06 billion, surpassing consensus of EUR14.9 billion, it said. Its investment result came in at EUR2.16 billion, well ahead of the expected EUR1.51 billion figure, and represented a return on investment of 3.8%.

“We still expect to generate a profit of EUR5 billion in 2024. In fact, it has become more likely that we will surpass that target,” its finance chief, Christoph Jurecka, said. The group anticipates sustained advantageous business opportunities in the coming quarters, it said.

Anheuser-Busch InBev said first-quarter net profit sharply fell despite revenue growth that was in line with market expectations.

The world’s largest brewer–which houses the Stella Artois and Budweiser brands among its portfolio–on Wednesday said net profit for the quarter was $1.09 billion from $1.64 billion a year earlier. This compares with market expectations of $1.17 billion, according to Visible Alpha consensus based on 15 analysts’ estimates.

On an adjusted basis, however, profit rose to $1.51 billion from $1.31 billion. Revenue for the quarter rose to $14.55 billion from $14.21 billion a year earlier.

The company reported organic revenue growth of 2.6%, in line with market expectations provided by the company and based on 17 brokers estimate published on April 15. Volume decreased 0.6%, compared with the company-provided market expectations of a 1.0% decrease.