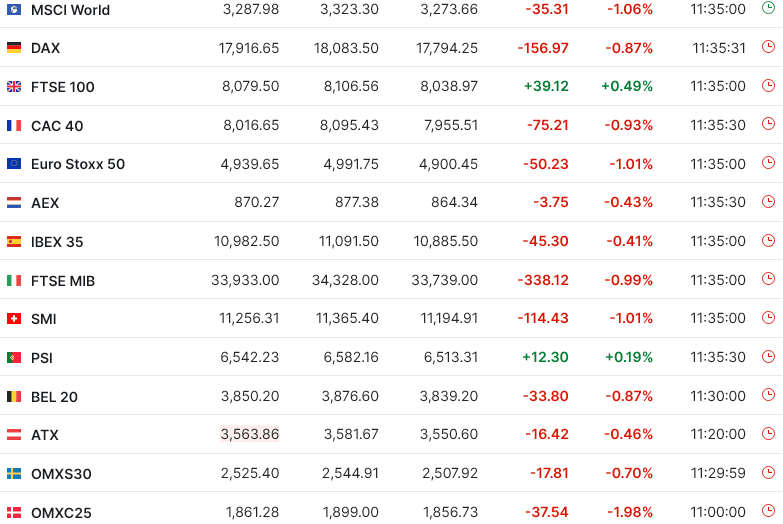

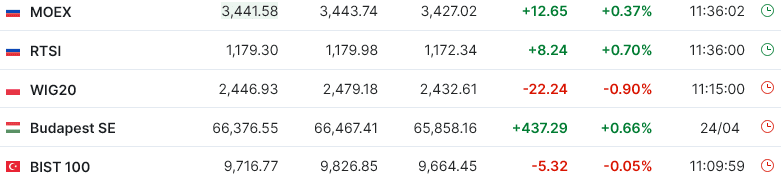

Σε αρνητικό έδαφος ολοκλήρωσαν σήμερα τα περισσότερα ευρωπαϊκά χρηματιστήρια, με τον κλάδο τεχνολογίας να πραγματοποιεί τα μεγαλύτερα κέρδη και αυτόν του real estate τις μεγαλύτερες απώλειες.

Επιφυλακτικοί παρουσιάστηκαν και σήμερα οι επενδυτές στα ευρωπαϊκά χρηματιστήρια, λόγω των ανακοινώσεων εταιρικών οικονομικών αποτελεσμάτων, με την προσοχή να εστιάζεται στον τραπεζικό κλάδο, αλλά και των μακροοικονομικών νέων στις ΗΠΑ.

Οι συμφωνίες ακινήτων στην Ευρώπη μειώθηκαν στον υψηλότερο αριθμό από την παγκόσμια χρηματοπιστωτική κρίση το πρώτο τρίμηνο του 2024, ανέφερε την Πέμπτη η εταιρεία παροχής στοιχείων MSCI Real Assets, καθώς η οικονομική αβεβαιότητα στην περιοχή εξακολουθεί να είναι μεγάλη.

Ο τομέας των εμπορικών ακινήτων στην Ευρώπη έχει πληγεί τα τελευταία χρόνια από την εξοντωτική αύξηση του κόστους χρέους και την πτώση των τιμών, η οποία επιδεινώθηκε από το άδειασμα ορισμένων γραφείων και κεντρικών δρόμων μετά την πανδημία. (περισσότερα εδώ)

Ο όμιλος BHP (NYSE:BHP) δήλωσε την Πέμπτη ότι υπέβαλε προσφορά εξαγοράς της Anglo American (JO:AGLJ) ύψους 38,8 δισ. δολαρίων, μια κίνηση που θα τοποθετούσε τη συνδυασμένη οντότητα ως τον μεγαλύτερο παραγωγό χαλκού στον κόσμο.

Η προσφορά της BHP ύψους 25,08 λιρών ανά μετοχή αντιπροσωπεύει premium 31% και περιλαμβάνει σχέδια για την εκποίηση των δραστηριοτήτων σιδηρομεταλλεύματος και πλατίνας της Anglo American στη Νότια Αφρική, περιοχές στις οποίες η BHP δεν έχει επί του παρόντος παρουσία. (περισσότερα εδώ)

Η Deutsche Bank κατέγραψε την Πέμπτη καλύτερη από την αναμενόμενη αύξηση 10% στα κέρδη του πρώτου τριμήνου, καθώς η ανάκαμψη των συναλλαγών σταθερού εισοδήματος και η σύναψη συμφωνιών ώθησε τα έσοδα του τμήματος επενδυτικής τραπεζικής.

Τα κέρδη σημαίνουν ότι η επενδυτική τραπεζική μπόρεσε να ανακτήσει τη θέση της ως ο μεγαλύτερος βιοποριστής της Deutsche από το γιγαντιαίο τμήμα λιανικής που επωφελήθηκε πρόσφατα από τα υψηλότερα επιτόκια αλλά υπέφερε από δυσλειτουργίες στην εξυπηρέτηση πελατών. (περισσότερα εδώ)

Η εμπιστοσύνη των Γερμανών καταναλωτών αυξήθηκε στο υψηλότερο επίπεδο από τον Μάιο του 2022, γεγονός που υποδηλώνει ότι η οικονομία της χώρας μπορεί να έχει γυρίσει σελίδα, μετά από παρόμοιο πιο αισιόδοξο κλίμα μεταξύ των επιχειρήσεων που δημοσιεύθηκε νωρίτερα αυτή την εβδομάδα.

Ο μελλοντικός δείκτης καταναλωτικού κλίματος για τη Γερμανία, που δημοσιεύθηκε την Πέμπτη από τον ερευνητικό όμιλο GfK και το Ινστιτούτο Αποφάσεων Αγοράς της Νυρεμβέργης, προβλέπει ότι η εμπιστοσύνη θα αυξηθεί στο μείον 24,2 τον Μάιο από μείον 27,3 αυτόν τον μήνα. (περισσότερα εδώ)

Ο δείκτης Stoxx 600 έκλεισε στις 502,34 μονάδες με πτώση 0,64%.

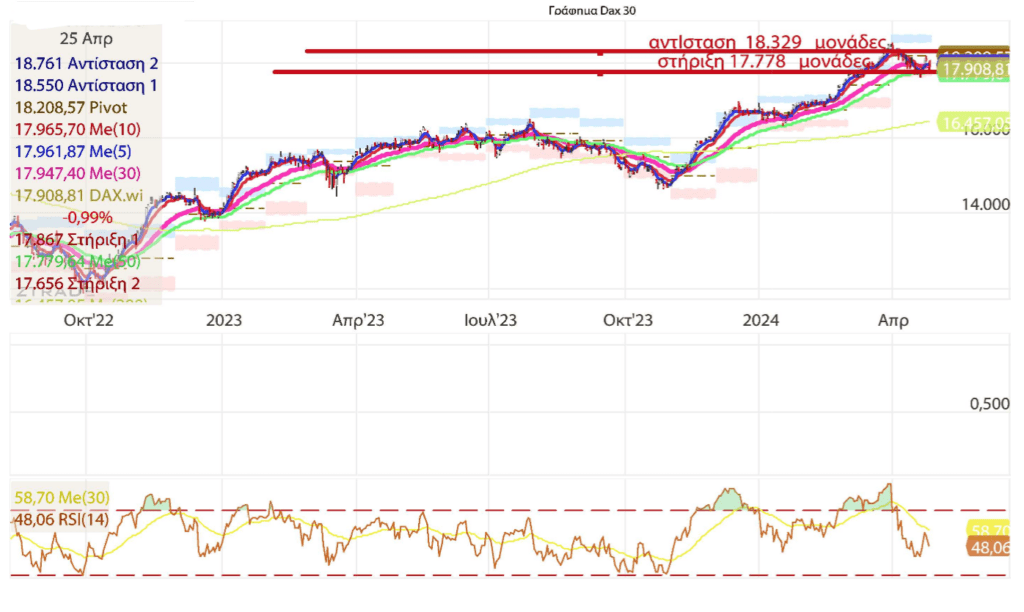

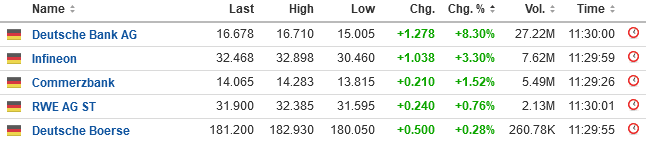

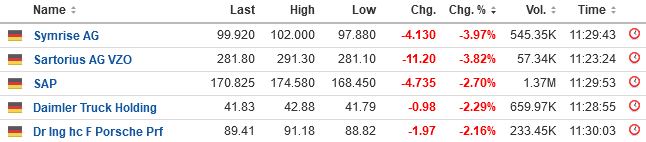

Στην Φρανκφούρτη ο δείκτης DAX έκλεισε στις 17.916,65 μονάδες με πτώση 0,87%, με το σήμα να μετατρέπεται από buy σε neutral, και με την αντίσταση να βρίσκεται στις 18.329 μονάδες και την στήριξη στις 17.778 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

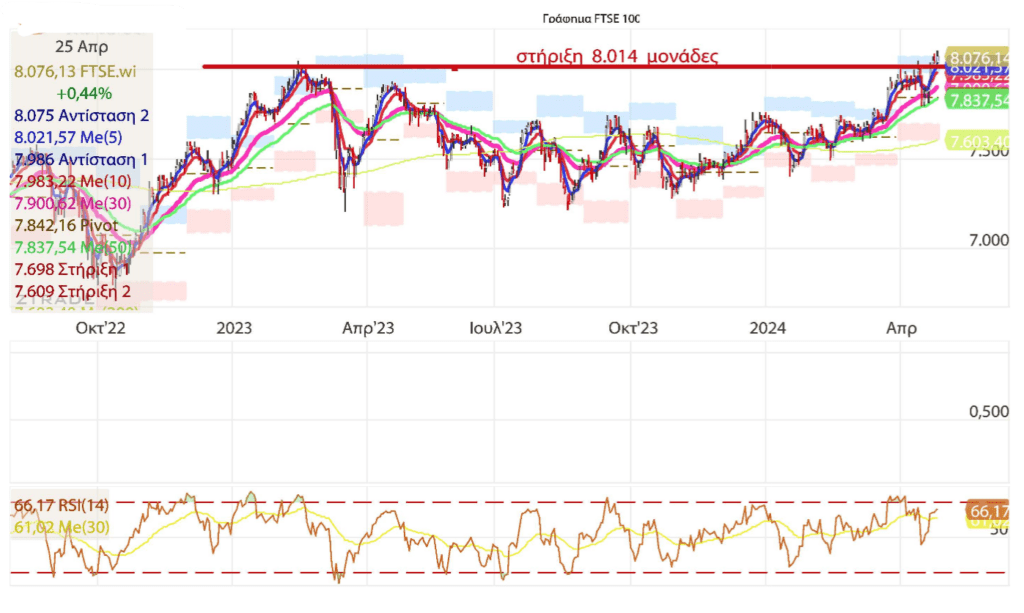

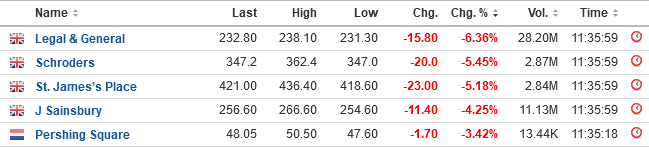

Στο Λονδίνο ο δείκτης FTSE 100 έκλεισε στις 8.079,50 μονάδες με άνοδο 0,49%, πραγματοποιώντας ενδοσυνεδρικά ιστορικό υψηλό στις 8.106,56 μονάδες, με το σήμα να διατηρείται σε strong buy, και με την στήριξη να βρίσκεται στις 8.014 μονάδες.

Μεγαλύτερη άνοδος

Μεγαλύτερη πτώση

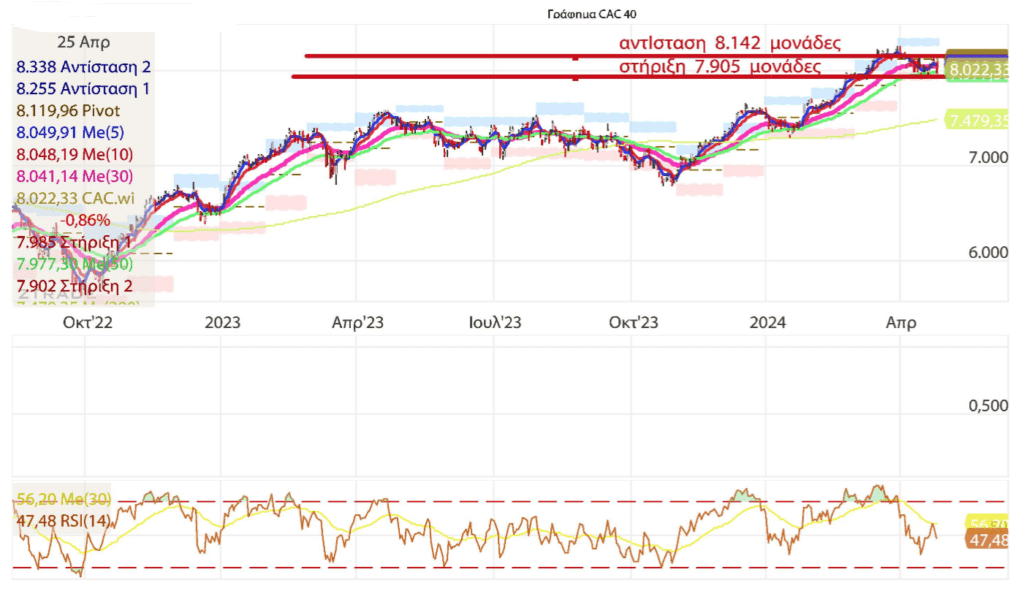

Στο Παρίσι ο δείκτης CAC 40 έκλεισε στις 8.016,65 μονάδες με πτώση 0,93%, με το σήμα να μετατρέπεται από strong buy σε neutral, και με την αντίσταση να βρίσκεται στις 8.142 μονάδες και την στήριξη στις 7.905 μονάδες.

Μεγαλύτερη άνοδος

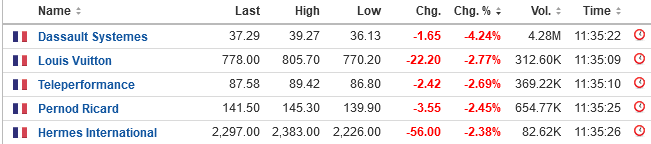

Μεγαλύτερη πτώση

Recommendations

ENI: Already positive, the research from JP Morgan and its analyst Christyan Malek still consider the stock as a Buy opportunity. The target price is still set at EUR 18.50.

Michelin: Jefferies reiterate its Sell rating. The target price remains unchanged at EUR 30.

Michelin: In a research note, JP Morgan analyst Jose Asumendi has maintained his recommendation on the stock with a Neutral rating. The target price is still set at EUR 28.

Vonovia: Charles Boissier from UBS retains his positive opinion on the stock with a Buy rating. The target price is still set at EUR 32.

Deutsche Borse: Enrico Bolzoni from JP Morgan retains his Neutral opinion on the stock. The target price has been modified and is now set at EUR 193 compared to EUR 198.

Εταιρικά νέα

Pernod Ricard posted a decrease in sales for its fiscal third quarter as it grapples with soft consumer sentiment in China and continues to reduce inventories in the U.S, and backed its guidance.

The maker of Absolut vodka and Martell cognac said Thursday that for the three months to the end of March sales fell 2% in reported terms to 2.35 billion euros ($2.51 billion) compared with the year-earlier period.

Analysts had forecast quarterly sales of EUR2.4 billion, according to a poll of estimates compiled by FactSet. The performance was hit by weak results in China, due to a difficult macroeconomic environment, and in the U.S., as trade inventory levels are adjusted, the company said.

The French distiller backed its mid-term financial targets, including reaching the upper end of between 4% and 7% of net sales growth and organic operating leverage of 50 to 60 basis points.

For the current year, the company expects broadly stable organic net sales, while it intends to continue to focus on growth and operational efficiencies, it said. Pernod Ricard said it will pay an interim dividend of EUR2.35 per share in July, while the final dividend will be subject to the decision at the company’s annual general meeting on Nov. 8.

Dove soap owner Unilever backed its full-year guidance after reporting better than-expected turnover for the first quarter as volumes and price dynamics normalize.

The Anglo-Dutch multisector retailer–which also owns consumer brands such as Cif and Domestos cleaning products–continues to expect sales to grow 3% to 5% this year and a modest improvement in operating margin, both on an underlying basis.

Schneider Electric reported a rise in revenue for the first quarter and reaffirmed its full-year targets, citing strong demand across most sectors and regions.

The French group said revenue for the first quarter came in at 8.61 billion euros ($9.21 billion), up 5.3% organically on year and beating analysts’ expectations of EUR8.57 billion, according to estimates provided by the company.

Performance was boosted by strong demand across most sectors and regions, particularly in data centers and infrastructure, the company said. Data-centers notched up strong double-digit growth that was broad-based across its regions, with a strong performance in North America, Western Europe and the rest of the world division, Schneider said.

Last week, the company confirmed that it was in talks with engineering-software company Bentley Systems about a potential strategic transaction in a deal likely valued at more than $15 billion. Many deals in recent years caused concern at their announcement but ultimately proved to be well-timed and structured, putting the company in an advantageous position, Berenberg analysts said in a note to clients. “One of the key things that Schneider has got right over the years is structuring deals in a value-accretive way for shareholders,” they said.

For 2024, the company reaffirmed its estimates. It continues to forecast adjusted earnings before interest, taxes and amortization of between 8% and 12% organically and organic revenue growth between 6% to 8%.

Lagardere posted higher revenue for the first quarter, led by strong growth at its travel retail business.

The French media company on Thursday posted revenue of 1.88 billion euros ($2.01 billion) for the January-through-March quarter, up 12% in reported terms and 8.9% like-for-like.

Lagardere’s travel retail business contributed EUR1.24 billion in revenue, up almost 19% in reported terms. Growth at Lagardere’s publishing business was shier at 1.1%.

“With global air traffic having returned to pre-pandemic levels, Lagardere Travel Retail delivered an increase in revenue in the majority of its operating regions,” said Chief Executive Arnaud Lagardere.

WPP logged in the first quarter its worst performance since late 2020, hurt by a pullback in spending by technology clients and project delays, but said it is on track to return to growth later this year.

The London-based advertising group said Thursday that its closely watched like-for-like revenue less pass-through costs fell 1.6% in the first three months of the year compared with the same period last year. Analysts polled by Visible Alpha had forecast a drop of 1.1%.

Like its peers, WPP–the owner of agencies including Ogilvy, Wunderman Thompson and VMLY&R–benefited in recent years from a postpandemic rebound in advertising and marketing spending. However, the company has seen momentum gradually wane in recent quarters as tech marketers turned more cautious and some clients postponed tech-related projects.

The company confirmed its guidance for growth of up to 1% in like-for-like revenue less pass-through costs this year. The metric is a gauge of the company’s underlying performance and strips out currency fluctuations, acquisitions, asset sales and costs such as expenses billed to clients.

WPP’s update wraps up the first-quarter reporting season for the major ad-agency holding groups, which showed mixed results for the industry with companies’ exposure to tech clients as a key factor.

Paris-based Publicis Groupe and U.S. peer Omnicom Group continued to grow at a steady pace, with organic net revenue rising 5.3% and 4.0% in the quarter, respectively, but the performances of WPP and Interpublic Group of Cos. were dragged by a pullback in tech spending.

Publicis earlier this month called out a clear rebound in the technology sector in the first quarter, a comment analysts saw as a positive signal for the likes of WPP and IPG.

However, WPP said reduced spend at tech companies and the loss of Pfizer creative duties weighed on the results of its global integrated agencies, while delays in project-based spending hit its specialist agencies. IPG, which on Wednesday reported organic net revenue growth of 1.3%, also said a recent decision by a big client might put the top end of its guidance range out of reach. “The first quarter of 2024 was very much in line with our expectations with performance reflecting the toughest comparator of the year,” WPP Chief Executive Mark Read said.

The first-quarter decline in WPP’s like-for-like revenue less pass-through costs marks its second fall in the last three quarters. It is also the company’s weakest result since the fourth quarter of 2020. WPP said total revenue for the quarter amounted to 3.41 billion pounds ($4.25 billion), down 1.4% on a reported basis.

Birkin bag maker Hermes posted an increase in sales for the first three months of the year, boosted by growth in all geographical areas.

The French luxury-handbag maker said Thursday that sales for the first quarter jumped to 3.805 billion euros ($4.07 billion), up 17% at constant currency compared with the prior-year period. The result came ahead of analysts’ forecasts of EUR3.68 billion, according to a poll of estimates compiled by Visible Alpha.

In the medium term, the company said it continues to expect revenue growth at constant exchange rates, despite the economic, geopolitical and monetary uncertainties around the world.

Delivery Hero raised its revenue forecasts for the year after sales jumped in the first quarter.

The German food-delivery company on Thursday posted revenue of 3.02 billion euros ($3.23 billion) excluding a hyperinflation adjustment for the January-through-March quarter, up 21% on year.

Gross merchandise value–the value of merchandise sold over a certain period–grew 8.3% to EUR12.13 billion, also excluding a hyperinflation adjustment.

Delivery Hero now expects revenue growth of 18% to 21% this year instead of 15% to 17% previously. The group continues to expect gross merchandise value growth of 7% to 9%, with adjusted earnings before interest, taxes, depreciation, and amortization of EUR725 million to EUR775 million and positive free cash flow.

Sanofi backed its full-year guidance after first-quarter sales and profit beat analysts expectations.

The French pharmaceutical company said Thursday that its business operating profit–one of the company’s preferred metrics, which strips out exceptional items–fell 15% to 2.84 billion euros ($3.04 billion). The company’s profitability was hit partly by higher costs.

Sales rose 2.4% to EUR10.46 billion, driven by continued strength in anti-inflammatory drug Dupixent and its new drug launches. Analysts expected business operating profit of EUR2.75 billion on sales of EUR10.27 billion, according to a poll of 14 analysts by Visible Alpha. Sanofi backed its earnings per share guidance for the year.

Schneider Electric reported a rise in revenue for the first quarter and reaffirmed its full-year targets on strong demand dynamics across most sectors and geographies.

The French group said revenue for the first quarter came at 8.61 billion euros ($9.21 billion), up 5.3% organically on year. Performance was boosted by strong demand dynamics across most sectors and geographies, particularly in data centers and infrastructure, the company said.

Revenue beat analysts’ expectations of EUR8.57 billion, according to estimates provided by the company. Last week, the company confirmed it is in talks with engineering-software company Bentley Systems about a potential strategic transaction in a deal valued at probably more than $15 billion.

For 2024, the company reaffirmed its estimates. It continues to forecast adjusted earnings before interest, taxes and amortization of between 8% and 12% organically and organic revenue growth between 6% to 8%.

Equinor will launch the second part of a share-buyback program after it posted slightly better-than-expected first-quarter results, despite a slide in gas prices.

The Norwegian energy major will purchase shares for up to $528 million in the market, with the total tranche of $1.6 billion including shares from the Norwegian state. Expected total capital distribution for 2024 is $14 billion, Equinor said.

In the first quarter, Equinor said adjusted earnings–its preferred measure–fell to $7.53 billion from $11.92 billion, still above the $7.20 billion expected in a company-compiled consensus. Revenue fell 14% to $25.14 billion as gas prices were lower than the previous year, the company said.

But Equinor reported slightly higher production per day compared with the same period last year, with increased capacity at its Norwegian Johan Sverdrup and Breidablikk oil fields. Meanwhile, its international upstream business delivered a 3% production increase on year, Equinor said.

The company reported a net profit of $2.67 billion, compared with $4.97 billion a year earlier, and against the $2.15 billion expected in a Factset poll. Strong margins were delivered in the quarter from crude, products and liquids, it said.

The company declared both an ordinary cash and extraordinary dividend of $0.35 each.

Dassault Systemes confirmed its full-year expectations after posting an increase in revenue for the first three months.

Reporting on a non-IFRS basis, the French software maker said Thursday that overall first-quarter revenue climbed to 1.5 billion euros ($1.61 billion) from EUR1.43 billion in the year-earlier period.

Software revenue increased to EUR1.35 billion from EUR1.29 billion, while services revenue rose to EUR146.8 million from EUR146 million. Operating profit jumped 5% to EUR466.5 million, with Dassault’s operating margin up to 31.1% from 31% previously.

Looking ahead, Dassault Systemes continues to anticipate revenue growth between 8% and 10% this year, excluding currency effects, and an operating margin of 32.5% to 32.8%.

For the second quarter, it expects revenue growth of 7% to 9%, excluding currency effects. It anticipates an operating margin of 31.3% to 31.5%.

Dassault Systemes, like other European software companies, presents its figures as two sets of numbers. One set is based on the International Financial Reporting Standards–an international accounting method that seeks to provide a global reporting standard–but analysts and investors tend to follow non-IFRS numbers. Those figures exclude share-based compensation, restructuring expenses and acquisition-related charges.

Deutsche Bank reported a higher profit for the first quarter due to cost controls and a rebound in investment-banking revenue that helped it offset the impact from stabilizing interest rates.

The German lender said Thursday that aftertax profit for the quarter was 1.45 billion euros ($1.55 billion), up 10% compared with the same period last year. Net profit climbed 10% to EUR1.275 billion.

Revenue rose to EUR7.78 billion from EUR7.68 billion, with increasing fee and commissions income making up for a decline in net interest income–the difference between what lenders earn from loans and pay for deposits–due to a stabilization in interest rates.

Analysts had forecast an aftertax profit of EUR1.38 billion on revenue of EUR7.71 billion, according to consensus estimates provided by the bank.

The group’s investment-banking division posted a 13% jump in quarterly revenue, while its corporate and private banks reported lower revenue. This makes Deutsche Bank the latest bank to report a resurgence in its investment-banking business following similar trends at U.S. peers.

Chief Executive Christian Sewing said this was the bank’s highest first-quarter profit since 2013, and that it is committed to deliver on its 2025 goals.

Nestle’s organic sales growth slowed sharply in the first months of the year as consumer demand remained weak, particularly in North America, while supply-chain disruptions continued to hold back volumes.

The Swiss maker of KitKat chocolate bars and Nescafe coffee said Thursday that organic sales rose 1.4% in the first-quarter, missing a company-compiled consensus of 2.9% and compared to 9.3% in the same quarter last year.

J Sainsbury narrowly beat its full fiscal-year profit guidance, as expected by analysts, largely due to strong grocery volume growth.

The British grocer said Thursday that underlying pretax profit for the year to March 2 was 701 million pounds ($873.8 million), just ahead of its targeted range of GBP670 million to GBP700 million. The figure–which strips out exceptional and other one-off items–also beat the GBP690 million it booked for fiscal 2023, but fell slightly short of a consensus forecast of GBP703 million compiled by the company.

On a statutory basis, pretax profit fell 15% to GBP277 million from GBP327 million, while revenue increased to GBP32.70 billion from GBP31.49 billion as grocery sales rose 9.4%. Retail sales grew 6.8%. Sainsbury’s was expected to report GBP32.60 billion in revenue, based on a FactSet-compiled consensus forecast.

For the current fiscal year, Sainsbury is targeting an underlying operating profit of between GBP1.01 billion and GBP1.06 billion. This increase will be partly driven by growth in grocery volumes ahead of the market and cost savings, the company said.

The FTSE 100-listed company declared a final dividend of 9.2 pence a share, bringing the full-year dividend to 13.1 pence a share, the same as a year ago.

Barclays confirmed its 2024 guidance as it reported a better-than-expected fall in pretax profit for the first quarter.

The British lender on Thursday posted a pretax profit for the three months ended March 31 of 2.28 billion pounds ($2.84 billion) compared with GBP2.60 billion a year earlier. Pretax profit was expected to reach GBP2.195billion, according a company-compiled consensus.

The FTSE 100-listed bank’s total income slipped to GBP6.95 billion from GBP7.24 billion a year prior, coming in slightly ahead of consensus’s GBP6.89 billion. The 4% fall was attributed to lower fixed income instruments, currencies and commodities income in its investment bank, lower inflation-linked income and adverse product dynamics in Barclays U.K. deposits and mortgages. This more than offset higher structural hedge income, strong equities performance and balance growth in its U.S. consumer bank, it said.

The group reported Barclays U.K. net interest income–the difference between what banks earn on loans and pay clients for deposits–of GBP1.55 billion and a net interest margin of 3.09%.

Barclays backed its guidance for total income of GBP10.7 billion for the year, which includes GBP6.1 billion in net interest income from Barclays U.K. It still expects return on tangible equity to be above 10% for 2024 and posted a 12.3% return for the first quarter, ahead of estimates of 11.7%.

AstraZeneca posted increased first-quarter core earnings per share and sales that beat forecasts.

The Anglo-Swedish pharmaceutical giant said Thursday that its core earnings per share increased to $2.06 from $1.92 the prior-year period.

Total revenue rose 19% to $12.68 billion boosted by product sales and continued growth in Alliance Revenue from partnered medicines. Analysts expected core earnings per share at $1.92 on sales of $11.84 billion, according to a company-compiled consensus. AstraZeneca reiterated its full-year guidance.